Faculty : Mr. Anoop J S

Course : Share market analysis

Batch : MBA 2023-25

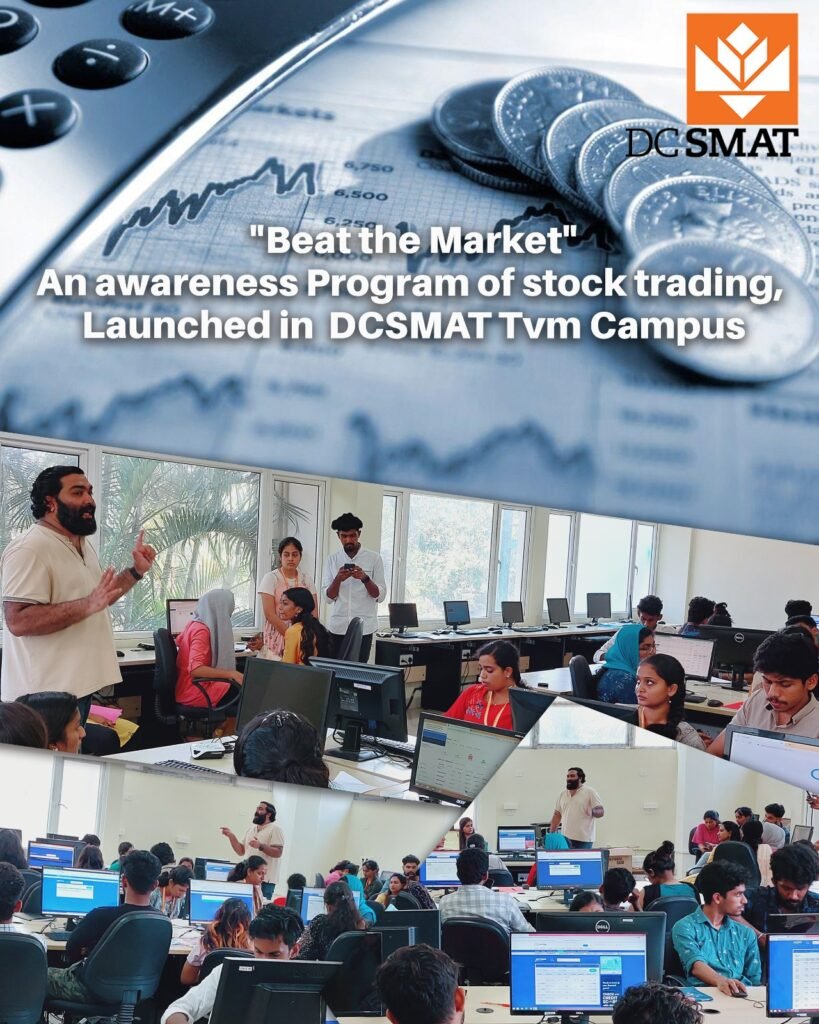

Activity : Beat the market

Objectives:

Overview:

Investing virtual money in the market and meticulously recording the value in a spreadsheet is a valuable educational and skill-building exercise that allows individuals to simulate real-world investment scenarios without financial risk. By diligently tracking investments, making informed decisions, analysing performance, and setting goals within the spreadsheet, participants gain practical insights into portfolio management, risk assessment, and investment strategy development, all while fostering continuous learning and financial literacy.

Activity:

Moneybhai is the platform where virtual money will be available the virtual money is used for investment.

Invest the 1 cr virtual money in the moneybhai in 25 different company of our choice.

The money invested in different companies must be observed from the day of investment only on the working day the market will be available.

Each day the value of share is observed.

The value of each share value in different companies should be recorded.

Date, Opening value, closing value ,difference, percentage, index opening value, closing value, difference, percentage of each share is recorded in the google sheet and updated regularly.

Benefits:

Conclusion:

Thus the activity of investing virtual money in the market and recording its value in a spreadsheet offers a risk-free yet valuable opportunity for individuals to learn and hone their investment skills. It serves as an effective educational tool, enabling participants to practice decision-making, portfolio management, and financial analysis. The knowledge and experience gained through this activity can be transferred to real-world investing, empowering individuals to make more informed and strategic financial decisions.

Discover courses that fit your interests, career aspirations, and learning style with our personalized course recommendations.

Our admission experts are highly knowledgeable professionals who can assist you in navigating the admissions process for various courses and programs.

© 2023, www.dcschool.net